White Paper on Advance Financial Accounts

COURTESY :- vrindawan.in

Wikipedia

Financial accounting is the field of accounting concerned with the summary, analysis and reporting of financial transactions related to a business. This involves the preparation of financial statements available for public use. Stockholders, suppliers, banks, employees, government agencies, business owners, and other stakeholders are examples of people interested in receiving such information for decision making purposes.

Financial accountancy is governed by both local and international accounting standards. Generally Accepted Accounting Principles (GAAP) is the standard framework of guidelines for financial accounting used in any given jurisdiction. It includes the standards, conventions and rules that accountants follow in recording and summarizing and in the preparation of financial statements.

On the other hand, International Financial Reporting Standards (IFRS) is a set of accounting standards stating how particular types of transactions and other events should be reported in financial statements. IFRS are issued by the International Accounting Standards Board (IASB). With IFRS becoming more widespread on the international scene, consistency in financial reporting has become more prevalent between global organizations.

While financial accounting is used to prepare accounting information for people outside the organization or not involved in the day-to-day running of the company, managerial accounting provides accounting information to help managers make decisions to manage the business.

Financial accounting and financial reporting are often used as synonyms.

1. According to International Financial Reporting Standards: the objective of financial reporting is:

To provide financial information that is useful to existing and potential investors, lenders and other creditors in making decisions about providing resources to the reporting entity.

2. According to the European Accounting Association:

Capital maintenance is a competing objective of financial reporting.

Financial accounting is the preparation of financial statements that can be consumed by the public and the relevant stakeholders. Financial information would be useful to users if such qualitative characteristics are present. When producing financial statements, the following must comply: Fundamental Qualitative Characteristics:

- Relevance: Relevance is the capacity of the financial information to influence the decision of its users. The ingredients of relevance are the predictive value and confirmatory value. Materiality is a sub-quality of relevance. Information is considered material if its omission or misstatement could influence the economic decisions of users taken on the basis of the financial statements.

- Faithful Representation: Faithful representation means that the actual effects of the transactions shall be properly accounted for and reported in the financial statements. The words and numbers must match what really happened in the transaction. The ingredients of faithful representation are completeness, neutrality and free from error.

Enhancing Qualitative Characteristics:

- Verifiability: Verifiability implies consensus between the different knowledgeable and independent users of financial information. Such information must be supported by sufficient evidence to follow the principle of objectivity.

- Comparability: Comparability is the uniform application of accounting methods across entities in the same industry. The principle of consistency is under comparability. Consistency is the uniform application of accounting across points in time within an entity.

- Under stand ability: Under stand ability means that accounting reports should be expressed as clearly as possible and should be understood by those to whom the information is relevant.

- Timeliness: Timeliness implies that financial information must be presented to the users before a decision is to be made.

The statement of cash flows considers the inputs and outputs in concrete cash within a stated period. The general template of a cash flow statement is as follows: Cash Inflow – Cash Outflow + Opening Balance = Closing Balance

Example 1: in the beginning of September, Ellen started out with $5 in her bank account. During that same month, Ellen borrowed $20 from Tom. At the end of the month, Ellen bought a pair of shoes for $7. Ellen’s cash flow statement for the month of September looks like this:

- Cash inflow: $20

- Cash outflow:$7

- Opening balance: $5

- Closing balance: $20 – $7 + $5 = $18

Example 2: in the beginning of June, Wiki Tables, a company that buys and resells tables, sold 2 tables. They’d originally bought the tables for $25 each, and sold them at a price of $50 per table. The first table was paid out in cash however the second one was bought in credit terms. Wiki Tables’ cash flow statement for the month of June looks like this:

- Cash inflow: $50 – How much Wiki Tables received in cash for the first table. They didn’t receive cash for the second table (sold in credit terms).

- Cash outflow: $50 – How much they’d originally bought the 2 tables for.

- Opening balance: $0

- Closing balance: $50 – 2*$25 + $0 = $50–50=$0 – Indeed, the cash flow for the month of June for Wiki Tables amounts to $0 and not $50.

Important: the cash flow statement only considers the exchange of actual cash, and ignores what the person in question owes or is owed.

The statement of profit or income statement represents the changes in value of a company’s accounts over a set period (most commonly one fiscal year), and may compare the changes to changes in the same accounts over the previous period. All changes are summarized on the “bottom line” as net income, often reported as “net loss” when income is less than zero.

The net profit or loss is determined by:

Sales (revenue)

– cost of goods sold

– selling, general, administrative expenses (SGA)

– depreciation/ amortization

= earnings before interest and taxes (EBIT)

– interest and tax expenses

= profit/loss

The balance sheet is the financial statement showing a firm’s assets, liabilities and equity (capital) at a set point in time, usually the end of the fiscal year reported on the accompanying income statement. The total assets always equal the total combined liabilities and equity. This statement best demonstrates the basic accounting equation:

Accounting, also known as accountancy, is the measurement, processing, and communication of financial and non financial information about economic entities such as businesses and corporations. Accounting, which has been called the “language of business”, measures the results of an organization’s economic activities and conveys this information to a variety of stakeholders, including investors, creditors, management, and regulators. Practitioners of accounting are known as accountants. The terms “accounting” and “financial reporting” are often used as synonyms.

Accounting can be divided into several fields including financial accounting, management accounting, tax accounting and cost accounting. Financial accounting focuses on the reporting of an organization’s financial information, including the preparation of financial statements, to the external users of the information, such as investors, regulators and suppliers; and management accounting focuses on the measurement, analysis and reporting of information for internal use by management. The recording of financial transactions, so that summaries of the financials may be presented in financial reports, is known as bookkeeping, of which double-entry bookkeeping is the most common system. Accounting information systems are designed to support accounting functions and related activities.

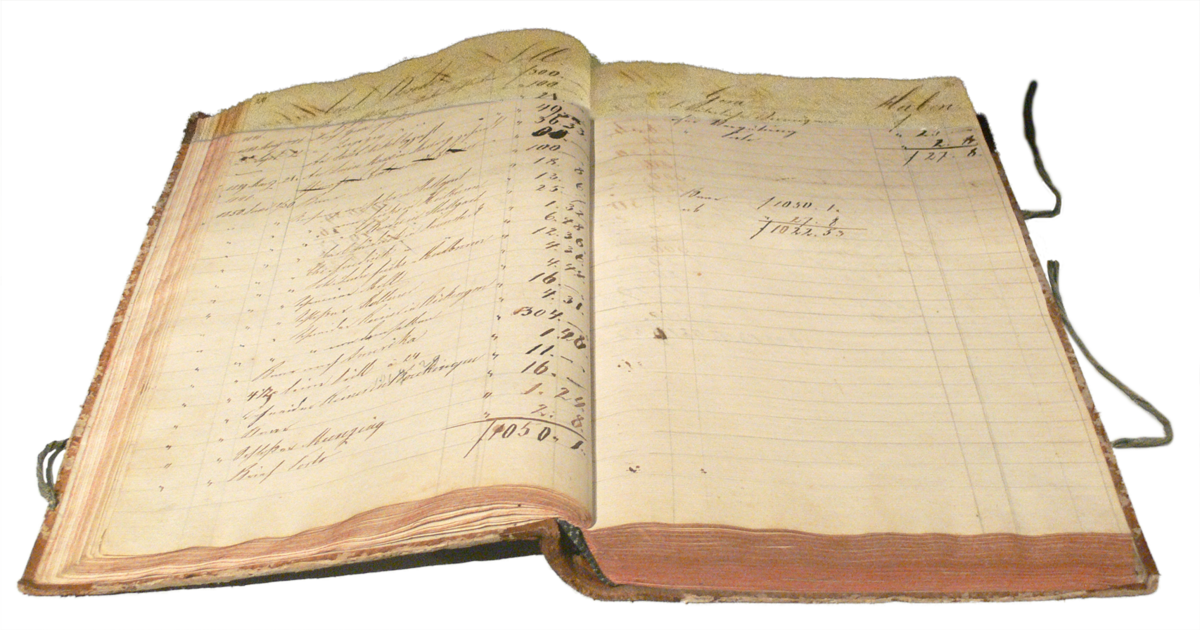

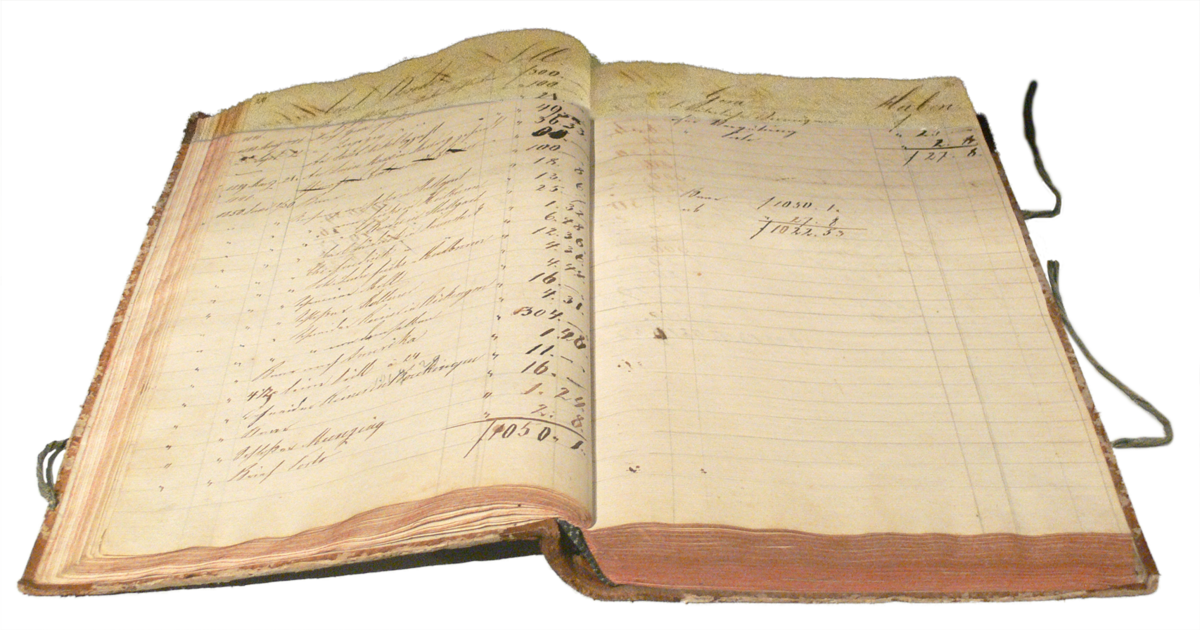

Accounting has existed in various forms and levels of sophistication throughout human history. The double-entry accounting system in use today was developed in medieval Europe, particularly in Venice, and is usually attributed to the Italian mathematician and Franciscan friar Luca Pacioli. Today, accounting is facilitated by accounting organizations such as standard-setters, accounting firms and professional bodies. Financial statements are usually audited by accounting firms, and are prepared in accordance with generally accepted accounting principles (GAAP). GAAP is set by various standard-setting organizations such as the Financial Accounting Standards Board (FASB) in the United States and the Financial Reporting Council in the United Kingdom. As of 2012, “all major economies” have plans to converge towards or adopt the International Financial Reporting Standards (IFRS).

Accounting is thousands of years old and can be traced to ancient civilizations. The early development of accounting dates back to ancient Mesopotamia, and is closely related to developments in writing, counting and money; there is also evidence of early forms of bookkeeping in ancient Iran, and early auditing systems by the ancient Egyptians and Babylonians. By the time of Emperor Augustus, the Roman government had access to detailed financial information.

Double-entry bookkeeping was pioneered in the Jewish community of the early-medieval Middle East and was further refined in medieval Europe. With the development of joint-stock companies, accounting split into financial accounting and management accounting.

The first published work on a double-entry bookkeeping system was the Summa de arithmetica, published in Italy in 1494 by Luca Pacioli (the “Father of Accounting”). Accounting began to transition into an organized profession in the nineteenth century, with local professional bodies in England merging to form the Institute of Chartered Accountants in England and Wales in 1880.